work opportunity tax credit questionnaire on job application

Below you will find the steps to complete the WOTC both ways. Using your computer or mobile device please visit website and complete the.

Adp Work Opportunity Tax Credit Wotc Avionte Bold

This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training.

. This government program offers participating companies between 2400 9600 per new qualifying hire. There are two sets of frequently asked questions for WOTC customers. This tax credit program has been extended until December 31 2025.

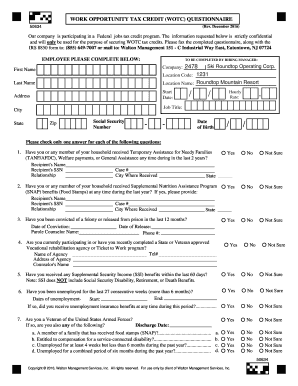

New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork or even as part of the employment application in some cases. Below you will find the steps to complete the WOTC both ways. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program.

40 percent of qualified first year wages for those employed 400 or more hours. Is presented with the Tax Credit Questionnaire 2012. Is participating in the WOTC program offered by the government.

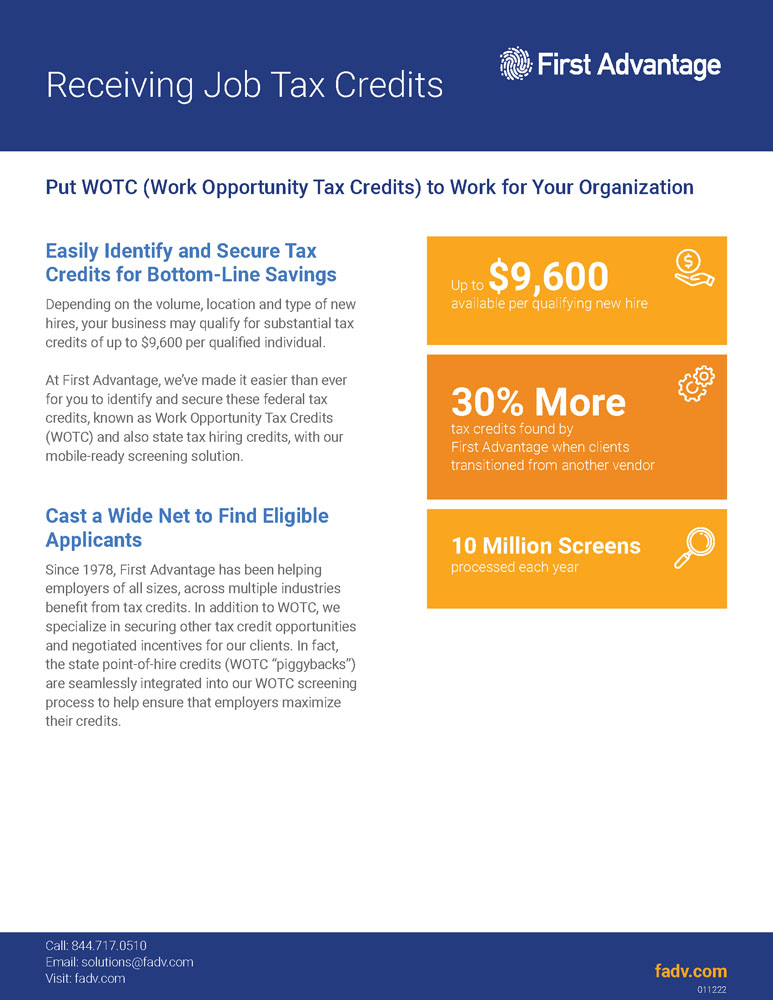

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. Questions and answers about the Work Opportunity Tax Credit program. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

Have applicants complete the questionnaire on the first page of Form 8850 on or before the job offer date to see if they qualify for one of the WOTC target groups. To provide a federal tax credit of up to 9600 to employers who hire these individuals. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. The sets up the system to screen applicants for tax credits on the job application. If the eligible employee works fewer than 400 hours but at least 120 hours the employer may claim a credit equal to 25 of the eligible employees wages.

Individuals hired as Summer Youth employees must work at least 90 days between May 1 and September 15 before an employer is eligible to claim the tax credit. Completing Your WOTC Questionnaire. How the Tax Credit Surveys are Used.

Work Opportunity Tax Credit WOTC Frequently Asked Questions. They are allowed to ask you to fill out these forms. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals.

Summer youth wages are capped at 3000. BENEFITS TO EMPLOYERS. EWOTC increases efficiency in processing new applications and decreases the.

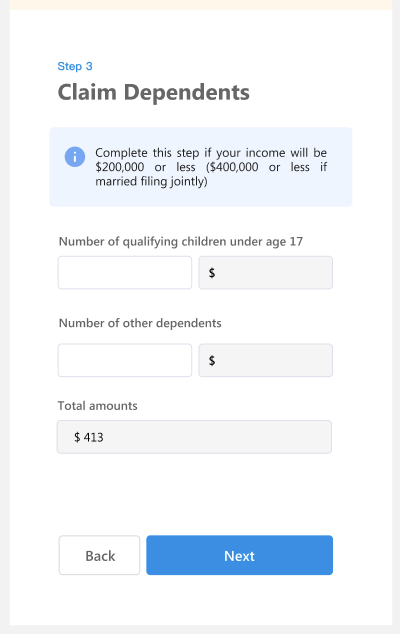

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA Form 9062. This is so your employer can take the Work Opportunity Tax Credit. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

The credit is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now.

The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who have consistently faced barriers to employment. Secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment.

Apply for Work Opportunity Tax Credits You can use the online service eWOTC to submit WOTC Request for Certification applications and to view and manage submitted applications. It also says that the employer is encouraged to hire individuals who are facing barriers to employment. 9600 depending on the targeted group and qualified wages paid to the new employee generally during the first year of.

Fill in the lines. Completing Your WOTC Questionnaire. This tax credit is dependent upon the new employee qualifying as a member of one of the below target groups and working a minimum of 120 hours in their first year.

Employers must apply for and receive a certification verifying the new hire is a. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. It asks for your SSN and if you are under 40.

The employee groups are those that have had significant barriers to employment. Qualified wages are capped at 6000. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Employers can still hire these individuals if they so choose but will not be able to claim the tax credit. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

An employer may claim a credit equal to 40 of the eligible employees qualified wages if the eligible worker works at least 400 hours during the first year of employment. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. The tax credit for hiring other target groups except summer youth employees is up to 2400 for each new hire.

The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. This questionnaire will not impact your personal information tax status or employment application in any way. WORK OPPORTUNITY TAX CREDIT WOTC QUESTIONNAIRE Job applicant.

Available ranges from. 25 percent for those employed at least 120 hours but less than 400. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service.

WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment. The Work Opportunity Tax Credit is a voluntary program. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

Yeah there are some people here who claim things like I have no highschool and have a 100k job or I do nothing at my job for 30 out of 40 hours or I landed a job after just 1 application and didnt even meet half the criteria. The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility questionnaire.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

New W4 Form Wotc Screening Features Product Updates

How To Optimize Wotc Screening Emptech Blog

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credits Wotc Walton

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit First Advantage

Wotc Questions What Is The Work Opportunity Tax Credit Questionnaire Cost Management Services Work Opportunity Tax Credits Experts

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit Youtube

Completing Your Wotc Questionnaire

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Retrotax Tax Credit Administration Jazzhr Marketplace

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller